-

Advocacy Theme

-

Tags

- Abortion

- Adoption

- Caregiving

- CEDAW

- Disability

- Domestic Violence

- Domestic Workers

- Harassment

- Healthcare

- Housing

- International/Regional Work

- Maintenance

- Media

- Migrant Spouses

- Migrant Workers

- Muslim Law

- National budget

- Parental Leave

- Parenthood

- Polygamy

- Population

- Race and religion

- Sexual Violence

- Sexuality Education

- Single Parents

- Social Support

- Sterilisation

- Women's Charter

Long-term care insurance for the nation should prioritise inclusivity

May 31st, 2018 | Letters and op-eds, News, Poverty and Inequality, Views

An edited version of this letter was originally published in The Straits Times Forum, 31 May 2018.

Correction: An earlier version of this letter inaccurately stated that 78% of women were out of the labour force because of family responsibilities; the presentation of this statistic has been corrected in the piece below. We apologise for any confusion caused.

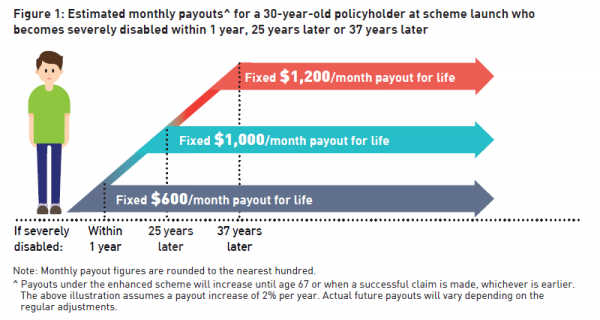

The government’s new scheme for long-term care insurance, CareShield Life, has the potential to prepare Singaporeans for the country’s growing healthcare needs, but it has major limitations.

We commend the inclusion of recipients with pre-existing disabilities into CareShield. This shows a willingness to create a scheme that is inclusive for everyone, in spite of their varying risk levels, hereditary conditions and existing healthcare needs. The pooling of risk across a population is the whole basis for insurance. However, this inclusivity seems to have stopped short at gender, with a stark gender difference in premium payments across the years.

This difference was explained as a way to factor in differences in life expectancy, and the likelihood and duration of severe disability between men and women. While this difference in payments may have been justified in the ElderShield Scheme as it is run by private insurers, CareShield is a not-for-profit insurance scheme run by the government, and principles of inclusivity should be given priority.

We must also consider the financial needs of women in Singapore. In 2016, 78% of prime working-age women outside the labour force were not working because of family responsibilities, including caregiving. Although the gap in average CPF balances between women and men has narrowed in the last decade, women still have 10% less CPF savings than men.

Overall, women are accumulating less money over the years, but, through CareShield, are required to pay higher premiums.

CareShield has scope to inclusively define who qualifies for its payouts. Currently, only those requiring help with three or more Activities of Daily Living (ADL) can receive the payout, which leaves behind those with moderate disabilities who require help with one or two ADLs. Such individuals may still require part- or full-time care, and this role of caregiving is often played by women who may have to give up paid work, leading to financial impoverishment in old age.

Another way to make CareShield more inclusive is by means-testing individual applicants, not households. In the current method of means-testing households, there is no assurance that financially better off family members are paying for the care expenditure, nor is there a guarantee that the care recipient can access the financial resources of other family members, such as the value of the residence.

We welcome the government’s move to introduce an inclusive long-term care scheme, but urge further public consultation to deliberate CareShield’s implications for more vulnerable communities, including women and the disabled.