-

Advocacy Theme

-

Tags

- Abortion

- Adoption

- Caregiving

- CEDAW

- Disability

- Domestic Violence

- Domestic Workers

- Harassment

- Healthcare

- Housing

- International/Regional Work

- Maintenance

- Media

- Migrant Spouses

- Migrant Workers

- Muslim Law

- National budget

- Parental Leave

- Parenthood

- Polygamy

- Population

- Race and religion

- Sexual Violence

- Sexuality Education

- Single Parents

- Social Support

- Sterilisation

- Women's Charter

Budget 2019: AWARE calls for a ‘4G’ budget for all generations

January 11th, 2019 | News, Older People and Caregiving, Press Release

This post was originally published as a press release on 11 January 2019.

Gender equality group AWARE submitted its ninth annual set of recommendations for the national Budget via public consultation platform REACH this morning.

Gender equality group AWARE submitted its ninth annual set of recommendations for the national Budget via public consultation platform REACH this morning.

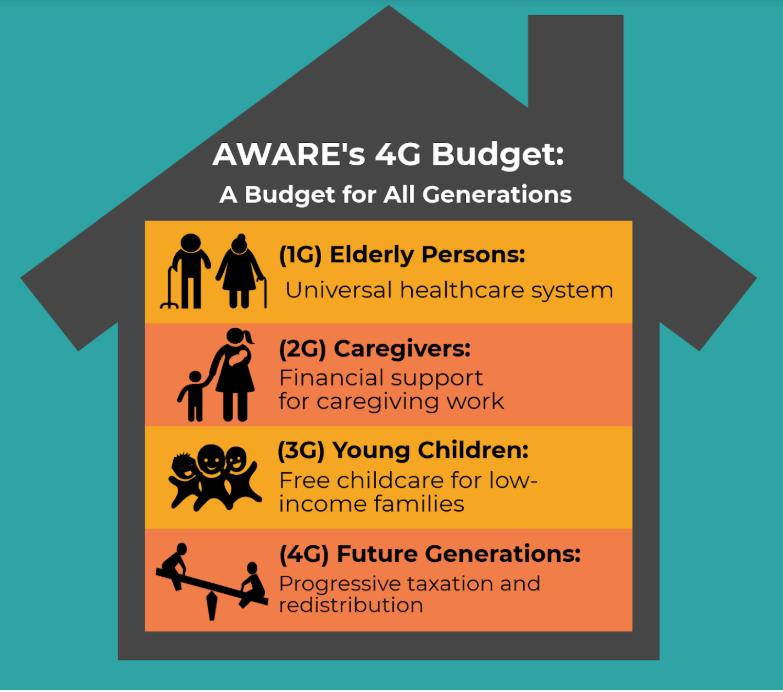

Taking a wide-ranging and comprehensive approach, AWARE designed this year’s recommendations to cover Singapore’s ‘4G’, or four generations – the grandparent, parent, children and future generations – with targeted interventions today addressing each of their needs tomorrow.

With the effects of Singapore’s ageing population in full swing, and total fertility rates continuing to decline, AWARE has dedicated recent efforts to examining the vicious cycle of intergenerational dependence created by current caregiving circumstances. When caregivers are forced to give up paid work in order to provide care for their families, they forgo opportunities to build adequate retirement savings, and have to depend on their descendants to care for them as they age. Those most adversely affected by this cycle are women (as family caregiving tends to fall to adult daughters or daughters-in-law) and low-income persons (for whom the financial burdens of unpaid caregiving loom proportionately larger). Interventions to ensure the financial security of caregivers therefore need to start earlier, before these groups age into poverty.

“There is an urgent need to build long-lasting support structures in the realm of caregiving, as those currently in place are proving imperfect,” said Shailey Hingorani, AWARE’s Head of Advocacy and Research. “The measures that 4G leaders take now may be able to dismantle systems of inequality—or may inadvertently uphold those systems for generations to come.”

“Our recommendations take into account all Singaporeans, but we urge consideration to be placed on women and low-income people in particular, as the challenges of caregiving—and ageing in general—are not gender-neutral, nor do they affect all socio-economic classes equally.”

AWARE’s recommendations harness the resources of Singapore’s existing population to put sustainable care infrastructures in place for the future. Here is an overview of the recommendations pertaining to each generation.

For 1G (Grandparents): Universal Healthcare System

- Extending the Pioneer Generation Package to all persons upon their reaching age 65, to augment Singaporeans’ current reliance on CPF and other limited schemes

- Making premiums for CareShield Life gender-neutral, instead of gender-differentiated, to make up for the relatively poor financial situation of women

For 2G (Parents): Direct Financial Support for Caregiving Work

- Implementing a matched savings scheme for women aged 30-55 who have not yet achieved half the Basic Retirement Sum (matching would end once the Basic Retirement Sum is reached)

- Providing a Caregivers’ allowance (a combination of CPF and cash), with amounts based on the salaries of paid caregivers, and varying according to the number of Activities of Daily Living that care recipients require assistance with

- Establishing a national database of caregivers: to track caregiver numbers in Singapore, disseminate information on caregiver training and incentives, and facilitate healthcare appointments

For 3G (Children): Free Childcare for the Low-Income

- Allowing all lower-income households to access subsidised childcare for free (regardless of mothers’ employment status), to boost early development and put every child on an equal footing

For 4G (Future): Progressive Taxation and Redistribution

- Introducing more progressive forms of taxation, including wealth tax (e.g. estate duty, capital gains tax), and higher personal income tax, to create a fairer society in the long run

More details can be found in our full submission. Recommendations that we have made for the National Budget in recent years can be found on our website: 2018, 2017, 2016, 2015, 2014.