-

Advocacy Theme

-

Tags

- Abortion

- Adoption

- Caregiving

- CEDAW

- Disability

- Domestic Violence

- Domestic Workers

- Harassment

- Healthcare

- Housing

- International/Regional Work

- Maintenance

- Media

- Migrant Spouses

- Migrant Workers

- Muslim Law

- National budget

- Parental Leave

- Parenthood

- Polygamy

- Population

- Race and religion

- Sexual Violence

- Sexuality Education

- Single Parents

- Social Support

- Sterilisation

- Women's Charter

How to Navigate the Financial Realities of Divorce: Part One (Pre-Divorce)

August 13th, 2020 | Family and Divorce, News

written by Bernard Foong and edited by Ashley Chua

Divorce is often a daunting process. It takes up time, energy and money, and demands a lot of emotional resources.

Regardless of whether or not you are prepared for it, the legal and financial reality of the process can hit hard for all parties. However, some basic knowledge of financial management and planning can empower you to know your rights and options during divorce. You could start planning to have funds put away – for expenses during divorce, and for financial needs after divorce.

This three-part article provides advice on three phases of divorce:

In this article, we will cover the pre-divorce phase. We recognise that women are often in a disadvantaged position financially and socially during divorce procedures. Nevertheless, the below information would be helpful to anyone contemplating divorce. (Lastly, divorce looks different for every individual. While these financial tips should point you in the right direction, you should seek more specific advice from experts familiar with your situation.)

PRE-DIVORCE PHASE

This is the phase where divorce proceedings have yet to commence. Your relationship may have strained, and you suspect that divorce may be in the cards soon. Or you may be contemplating divorce and realising that financial constraints are a big factor in the decision.

It is a good practice to start off by:

- Understanding the divorce process and its cost

- Organising and documenting the family’s financial situation

- Understanding your financial, emotional and practical needs

- Consider a maintenance order

- Seeking professional support for legal, financial and emotional matters

- Planning for yourself and your children

1. Understanding the Divorce Process

Many women who have called AWARE’s Helpline and/or attended our legal clinics have shared that they feel lost in a maze of legal procedures once divorce proceedings commence. Tight timelines need to be met. There are numerous trial conferences to attend and documents to be submitted. Sometimes, confusion about these processes even leads to extraneous costs being incurred. For example, researching and comparing multiple lawyers and their costs can greatly help your planning.

| Uncontested Divorce Typical Cost | Contested Divorce Typical Cost |

|---|---|

| $1,500 – $3,000 | $10,000 – $35,000 |

| Typical Legal Hourly Rate |

|---|

| Partner: $800/hr Senior Associate: $500/hr Junior Associate: $350/hr |

*taken from singaporelegaladvice.com dated 21 October 2019

There are also other resources available online for divorce processes and costs. Check out these two:

- Comprehensive guide to divorce costs by singaporelegaladvice.com

- Divorce processes guide by Law Society of Singapore

2. Organising and Documenting Family Financial Situation

Gathering key evidence and documents before filing for a divorce is a good idea – not just so you can plan for your post-divorce circumstances. It’s also useful so that your lawyer and the Court can decide how to apportion matrimonial assets and debts, and whether to award maintenance for the wife and children.

| Documents | Gather this to show: |

|---|---|

| Spouse’s IRAS statement | Spouse sources of income |

| Spouse’s Will, Property Deed, Bank Statement | Spouse assets |

| Spouse’s Credit Card Statement | Spouse debts |

| Groceries, Utilities, Internet, Mobile Bills | Family maintenance |

| Vehicle Maintenance Receipts | Family maintenance |

| Meals and Clothing Expenses | Personal maintenance |

| Insurances and Savings Policies | Personal and children maintenance |

| Tuition Bills, School Fees, Education | Children maintenance |

(Under the Women’s Charter, matrimonial assets are: assets acquired by one or both parties during the marriage, assets used by any spouse or their children for various purposes, or assets acquired before the marriage but substantially improved during the marriage. Gifts or inheritance [and things that have not been substantially improved during the marriage] are not considered matrimonial assets.)

Apart from the aforementioned documents, if you were not employed/gave up employment to contribute towards home and supporting your family, do consider your own employment opportunities post divorce. In post-divorce financial planning, employment can be an important stream of income for financial sustainability. Hence, at this stage, it could also be timely to revisit your educational and prior work experiences in anticipation of (re-)joining the workforce.

3. Understanding Your Financial, Emotional and Practical Needs

In divorce, individuals typically are put into a position where they need to juggle multiple financial, emotional and practical considerations. Often, the cost of litigation comes up against other current and future financial needs, one’s emotional health, the needs of children, and many other factors.

Here are some questions to consider at this stage:

- Should I self-represent or seek out a lawyer? How much time would a divorce take up in my daily life if I were to self-represent? How much more costly would a lawyer be?

- How might the divorce process affect my work hours and my childcare schedule?

- How might having a lawyer support my emotional needs?

- Would contesting the divorce be affordable?

To reiterate, there is no one-size-fits-all approach. You are the expert on your own situation. The goal when planning for divorce is simply to know what’s best for you with information, guidance and support.

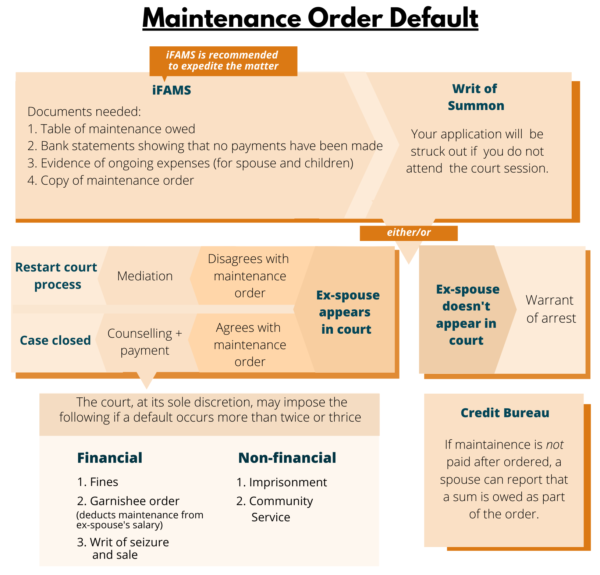

4. Consider a Maintenance Order

In anticipation of the expenses and changes in financial situation, you may consider applying for a maintenance order for yourself, and for your children.

It is crucial to be informed of the procedure so that you do not waste unnecessary time and resources trying to figure out the next course of action. Refer to the diagramme for more information.

5. Seek Professional Support

After doing some of your own research on divorce, understanding your family’s current and future financial, emotional and practical needs, as well as documenting your finances, you can also seek professional support.

If you are uncertain, and if you can, it is beneficial to speak to professionals in their specialised trade – legal, financial counselling, emotional counselling.

If you need less pricey alternatives to private legal counsel, here are some of them:

- Legal clinics islandwide provide free legal advice sessions, ranging from 20-40 minutes. The AWARE legal clinics provide you with a one-time free 20-minute legal clinic session. Call 1800-777-5555 to get a referral. You can also check your eligibility with other Singapore legal clinics at legalclinics.sg

- The Legal Aid Bureau provides pro bono legal aid to Singaporeans and PRs for a number of legal issues. Contact them to check your eligibility. Otherwise, foreigners can contact ACMI to check if they are able to provide legal aid.

- Some private firms offer a short free or discounted first consultation.

Counselling services are also available islandwide at counselling centres, Family Service Centres and specialised social services, such as Divorce Specialist Support Centres. AWARE also provides individual counselling for women. To seek counselling support at AWARE, call 1800-777-5555 to get a referral.

By regulation, assisting in divorce financial matters is not within the scope of responsibility of a financial planner in Singapore (this may be different in other countries). However, you may reach out to a financial planner for general financial planning that arises out of a divorce – for example, documenting your family’s financial situation in general, making changes to your insurance plans or selling your assets.

6. Planning for Yourself and Your Children

In the next two installments, we will be talking about financial planning during divorce and for your life post-divorce. You’ll consider the following questions:

- What new financial needs will my children and I have after divorce? How can I ask for financial support for these needs from my ex-spouse?

- What new environment do I wish my children to grow up in? How can I make provisions for it? (Eg. living arrangements, childcare needs, etc.)

- How can I protect my financial assets during and post-divorce?

Bernard is a financial educator who strongly believes in the rights of everyone to access information on financial planning. Witnessing his mother’s financial and emotional vulnerability from her marital failure, spurred him to use his financial knowledge to support women considering divorce. He currently volunteers with AWARE’s CARE services to raise awareness about the need for financial planning for women contemplating or undergoing divorce.