-

Advocacy Theme

-

Tags

- Abortion

- Adoption

- Caregiving

- CEDAW

- Disability

- Domestic Violence

- Domestic Workers

- Harassment

- Healthcare

- Housing

- International/Regional Work

- Maintenance

- Media

- Migrant Spouses

- Migrant Workers

- Muslim Law

- National budget

- Parental Leave

- Parenthood

- Polygamy

- Population

- Race and religion

- Sexual Violence

- Sexuality Education

- Single Parents

- Social Support

- Sterilisation

- Women's Charter

How to Navigate the Financial Realities of Divorce: Part Three (Post-Divorce)

August 21st, 2020 | Family and Divorce, News

written by Bernard Foong and edited by Ashley Chua

Divorce takes up time, energy and money, and demands a lot of emotional resources. Regardless of whether or not you are prepared for it, the legal and financial reality of the process can hit hard for all parties. However, some basic knowledge of financial management and planning can empower you to know your rights and options during divorce. You could start planning to have funds put away—for expenses during divorce, and for financial needs after divorce.

Divorce looks different for every individual. Hence, you should seek more specific advice from experts familiar with your situation. Nonetheless, these financial tips should point you in the right direction.

This three-part article provides advice on three phases of divorce:

This is part three: the post-divorce phase.

POST-DIVORCE PHASE

You may have received the final judgment of divorce. A new life may have accompanied this, with changes in your career or working arrangements, new housing and childcare needs, and other adjustments.

You may have regained some ability to rebuild a financial future for you and your children. Self-sufficiency and long-term planning are essential. Consider asking yourself these questions:

- How will you continue to engage with your ex-spouse?

- How can you map your financial needs and resources?

- What can you do to safeguard your health?

- How can you seek support for your changing financial needs?

1. How will you continue to engage with your ex-spouse?

After divorce, you and your ex-spouse will likely still be involved in each other’s lives. If you have no children with your ex-spouse, you may have to engage with him about maintenance for yourself, matters involving your matrimonial home, and other pending legal matters.

If you do have children with your ex-spouse, you’ll probably have to engage with him about all the above, plus maintenance for your children, as well as custody, care and control, and access to them.

Maintenance

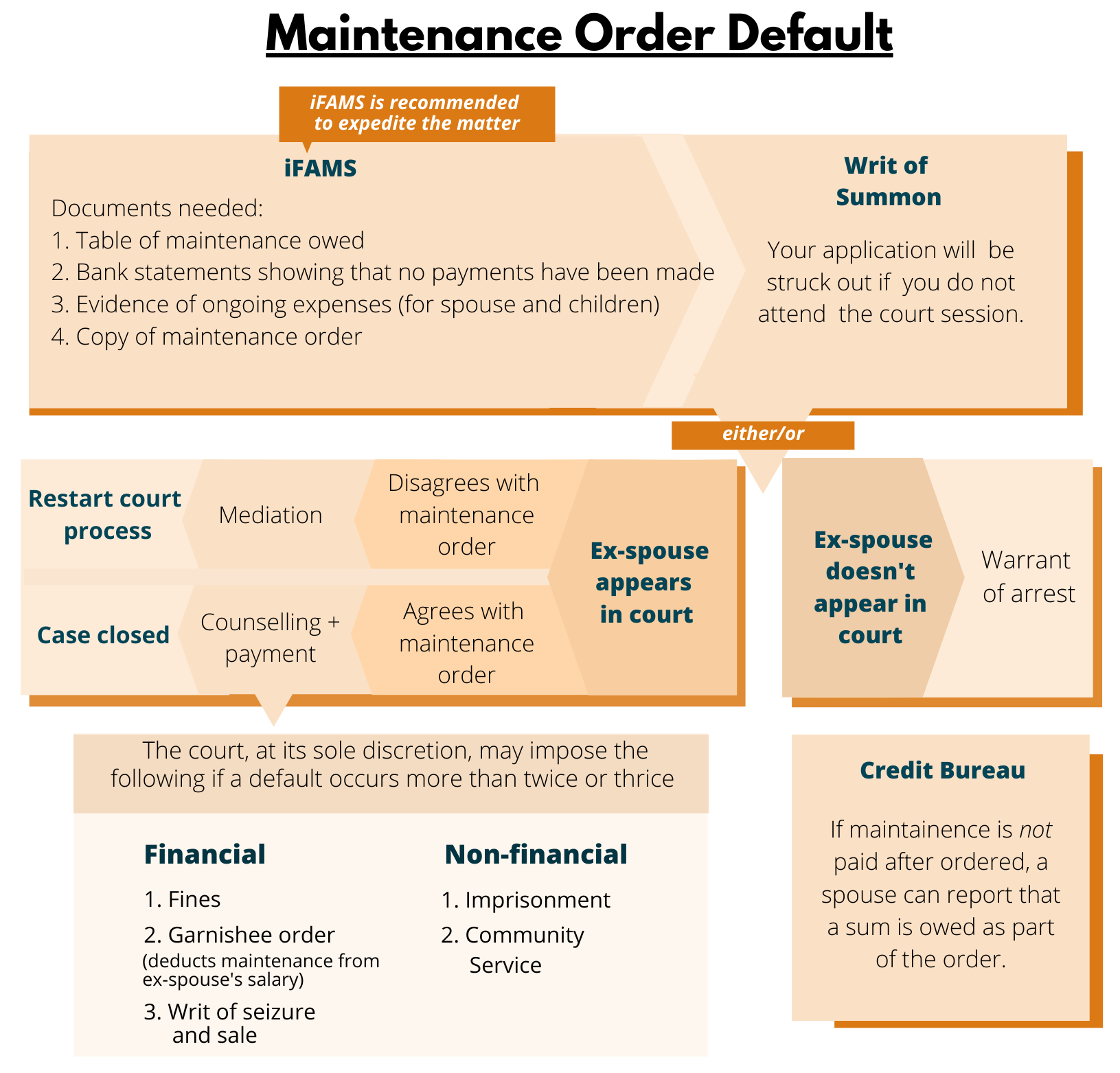

The ex-spouse may default on maintenance payments, citing reasons such as job loss, health issues and so on. The truth of these reasons will be determined by the Court, with the appropriate remedies should they turn out to be false. Consider filing an Enforcement of Maintenance Order under Family Justice Court and reporting to the Credit Bureau, especially if your ex-spouse is concerned about credit reputation. Refer to the diagramme for more information.

If the ex-spouse is determined not to comply with the maintenance order, you may need to attend numerous court hearings, which could be trying. However, know that there is support available for your emotional, legal and financial needs (see below).

2. How can you map your financial needs and resources?

It is essential to review whether your current financial resources are enough for you and your household. An immediate consideration would be to set aside a minimum of six months to a year of your monthly expenditure as emergency cash to cater for unexpected events, including a default on your maintenance.

Additionally, you may also need to ensure that you and your household insurance needs have been re-established. Your ex-spouse may cancel the entire household insurance and surrender all policies to claim the proceeds, to the detriment of you and your household. Protect your financial status with the appropriate beneficiaries to your estate by doing a comprehensive assessment.

Here are basic financial management principles, useful in any financial situation. These can be further explored with a financial consultant.

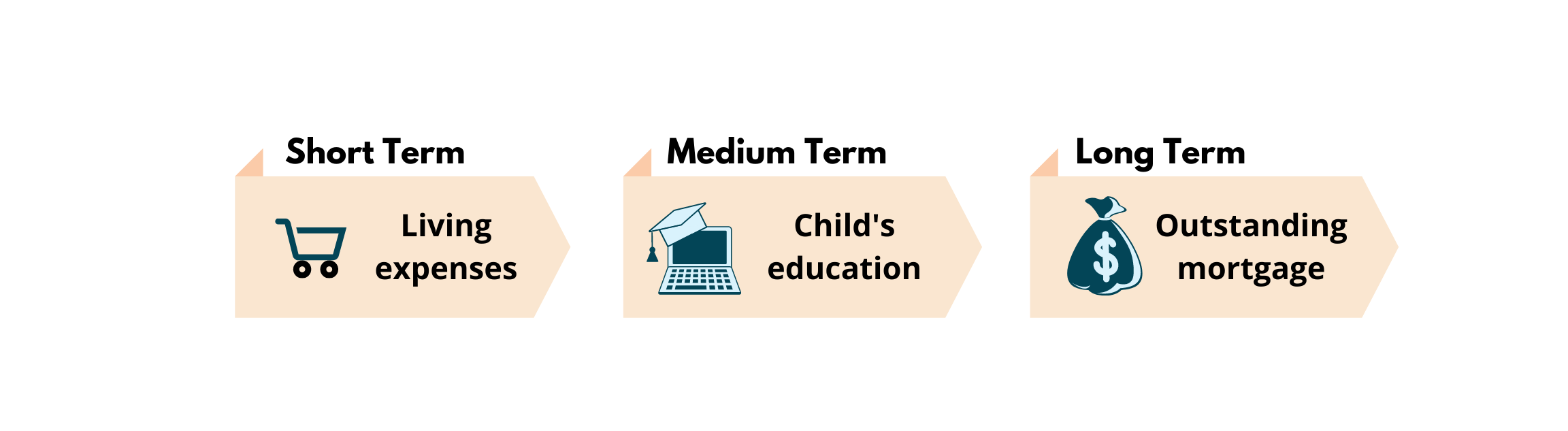

- Principle 1: Identify short-, medium- and long-term financial objectives:

- Principle 2: Prioritise all your financial objectives into two categories: needs and wants

- Principle 3: Match your needs to your guaranteed income and wants to your non-guaranteed income

- Examples of guaranteed income: CPF life, annuity, fixed deposits

- Examples of non-guaranteed income: Property rental, investments, alimony

- Principle 4: Seek out loans that you are able to repay

- Principle 5: If there is a gap in your financial needs, seek assistance as soon as possible

3. What can you do to safeguard your health?

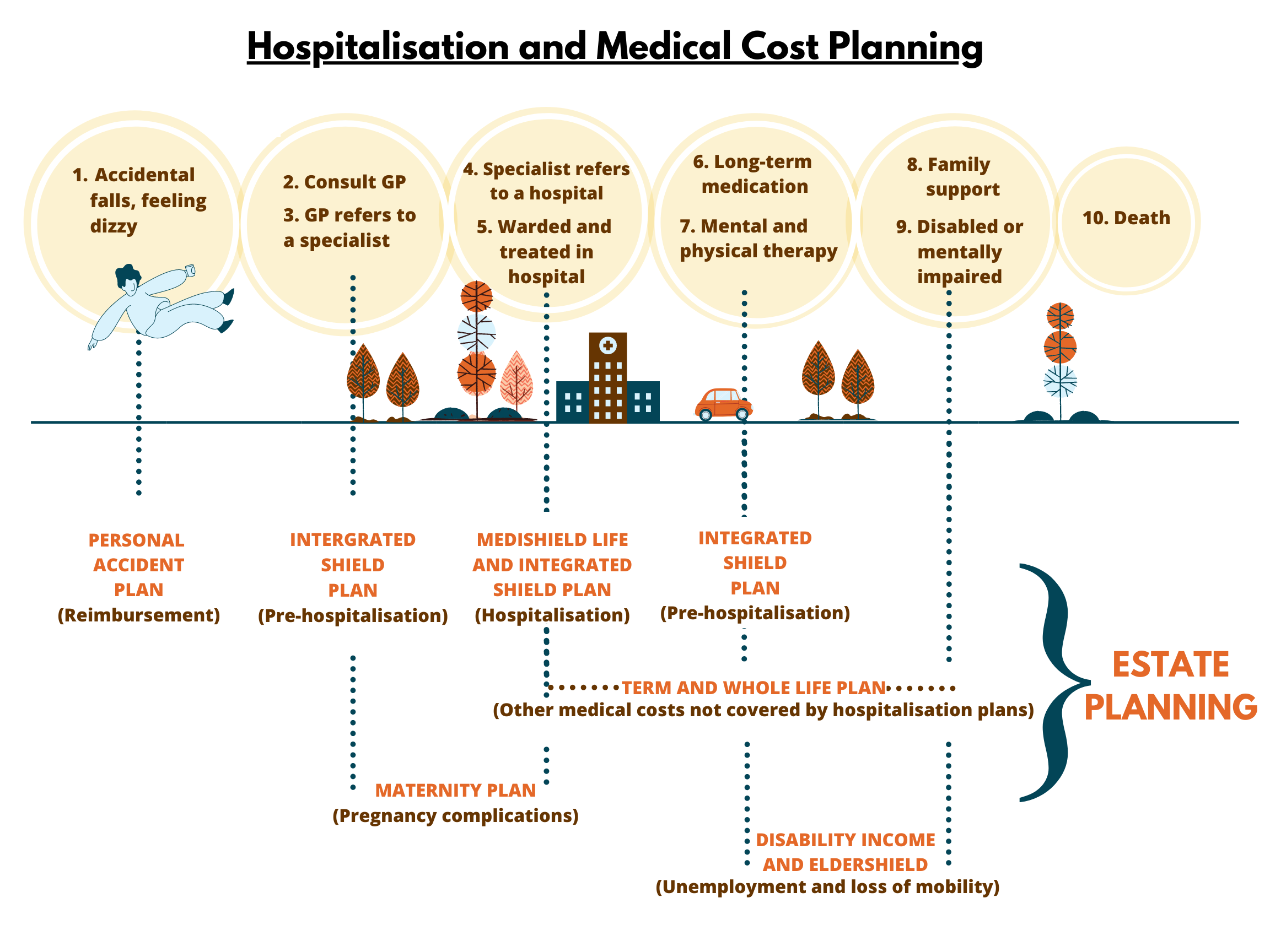

Medical planning includes planning for your physical and mental health. Below is an overview of what a medical plan should look like.

Apart from physical health, declining mental health is also a concern. Protect yourself with the Lasting Power of Attorney and appoint someone who will make the best decisions when you are mentally impaired—the time when you are most vulnerable and dependent on others. Refer to the information by the Office of Public Guardian below or seek professional advice.

4. How can you seek support for your changing financial needs?

Clients of AWARE have shared that the legal proceedings, the adjustment period, and lifestyle changes that accompany divorce do take a toll on their savings. Here are some avenues for financial support:

- Speak to a social worker at a Family Service Centres near you to get information on programmes that offer financial aid

- Apply for various types of assistance, such as ComCare financial assistance, job matching and family services at your nearest Social Service Office

- Visit AWARE’s online resource for single parents for more information on government parenting support schemes, HDB policy and important legal issues. (Note: The site is specifically for unmarried single mothers, but some information is applicable for divorced single mothers.)

Counselling services are also available islandwide at counselling centres, all Family Service Centres and specialised social services, such as Divorce Specialist Support Centres. AWARE also provides individual counselling for women. To seek counselling support at AWARE, call 1800-777-5555.

By regulation, assisting in divorce financial matters is not within the scope of responsibility of a financial planner in Singapore. (This may be different in other countries.) However, you may reach out to a financial planner for general financial planning that arises out of a divorce—for example, documenting your family’s financial situation in general, making changes to your insurance plans, or selling your assets.

Bernard is a financial educator who strongly believes in the rights of everyone to access information on financial planning. Witnessing his mother’s financial and emotional vulnerability from her marital failure, spurred him to use his financial knowledge to support women considering divorce. He currently volunteers with AWARE’s CARE services to raise awareness about the need for financial planning for women contemplating or undergoing divorce.