-

Advocacy Theme

-

Tags

- Abortion

- Adoption

- Caregiving

- CEDAW

- Disability

- Domestic Violence

- Domestic Workers

- Harassment

- Healthcare

- Housing

- International/Regional Work

- Maintenance

- Media

- Migrant Spouses

- Migrant Workers

- Muslim Law

- National budget

- Parental Leave

- Parenthood

- Polygamy

- Population

- Race and religion

- Sexual Violence

- Sexuality Education

- Single Parents

- Social Support

- Sterilisation

- Women's Charter

How to Navigate the Financial Realities of Divorce: Part Two (Mid-Divorce)

August 18th, 2020 | Family and Divorce, News

written by Bernard Foong and edited by Ashley Chua

Divorce takes up time, energy and money, and demands a lot of emotional resources. Regardless of whether or not you are prepared for it, the legal and financial reality of the process can hit hard for all parties. However, some basic knowledge of financial management and planning can empower you to know your rights and options during divorce. You could start planning to have funds put away – for expenses during divorce, and for financial needs after divorce.

Divorce looks different for every individual. Hence, you should seek more specific advice from experts familiar with your situation. Nonetheless, these financial tips should point you in the right direction.

This three-part article provides advice on three phases of divorce:

This is part two: the mid-divorce phase.

MID-DIVORCE PHASE

So you have received or filed the Writ of Divorce, and now you’re contemplating your next step. Here are some common financial considerations:

- How can you defend yourself against financial abuse by your spouse?

- What are your post-divorce financial considerations?

- How can you protect financial assets for yourself and for your children?

- Should you terminate jointly owned properties?

- Should you update the beneficiaries of your will and insurance policies?

Let’s answer these one by one.

1. How can you defend yourself against financial abuse by your spouse?

It is possible for a spouse to exert additional financial pressure to coerce you into an unfavourable divorce settlement. Some common tactics employed include:

- Withdrawing money from a joint account

- Maximising the credit card limit from your supplementary credit card

- Refusing to support household expenses until ordered to do so

- Refusing to cooperate in mediation, with the intent of increasing legal fees

- Contesting the divorce or ancillary matters, with the intent of complicating or dragging out the divorce process

You have options to protect yourself from such actions. Provide evidence as and when these thing happen and, if you are represented, present it to your lawyer. Interlocutory applications – such as a maintenance order, and interim care and control for children – can be filed. The Court may consider such conduct by the spouse as prejudicing in its judgment.

2. What are your post-divorce financial considerations?

In the midst of divorce, you and your spouse may disagree on the division of matrimonial assets, maintenance for you and your children, as well as child custody, care and control. Either party may contest proposed arrangements for any of these items. Some lawyers may advise their clients to aim towards minimising the financial impact to them and their family.

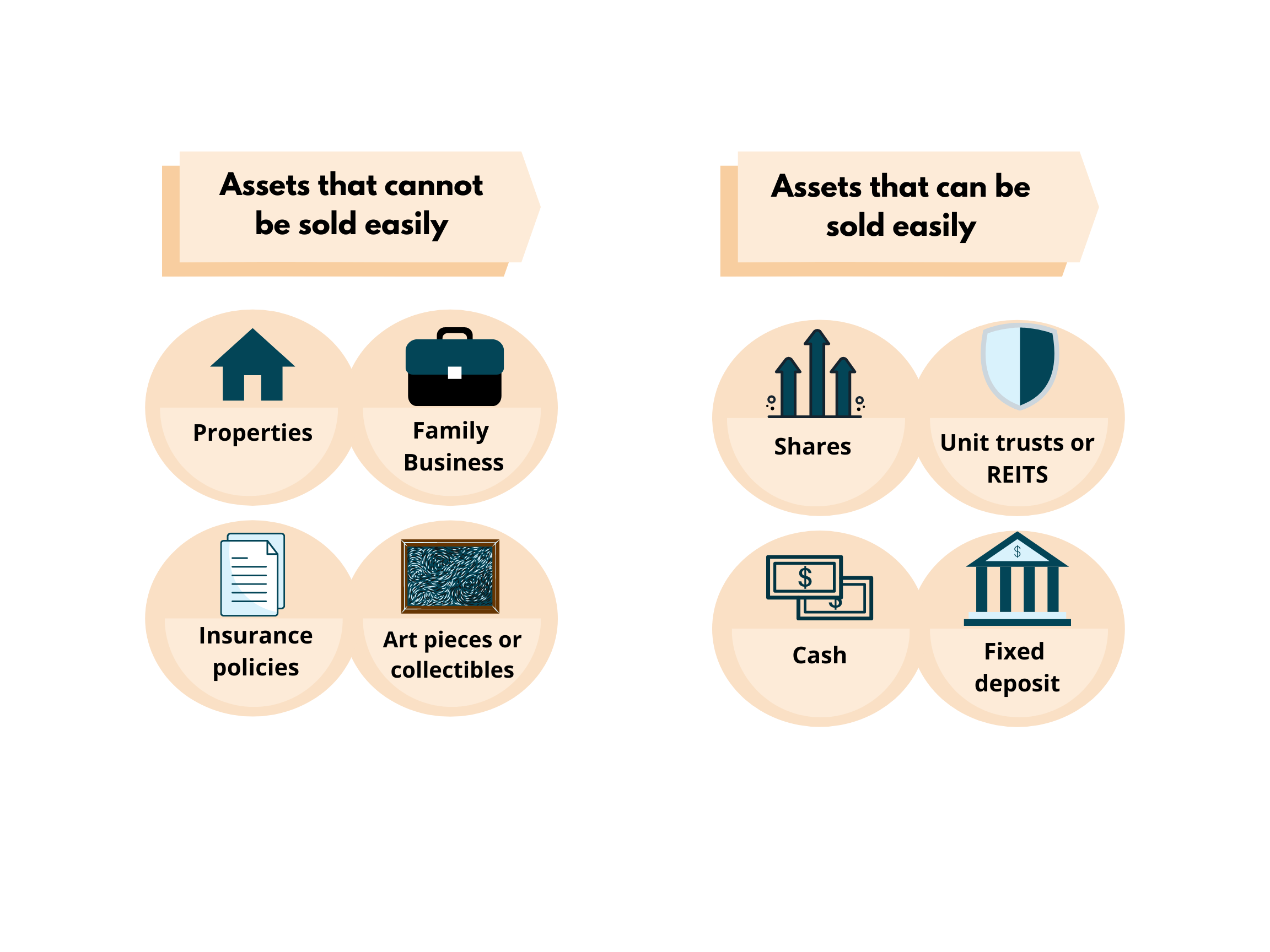

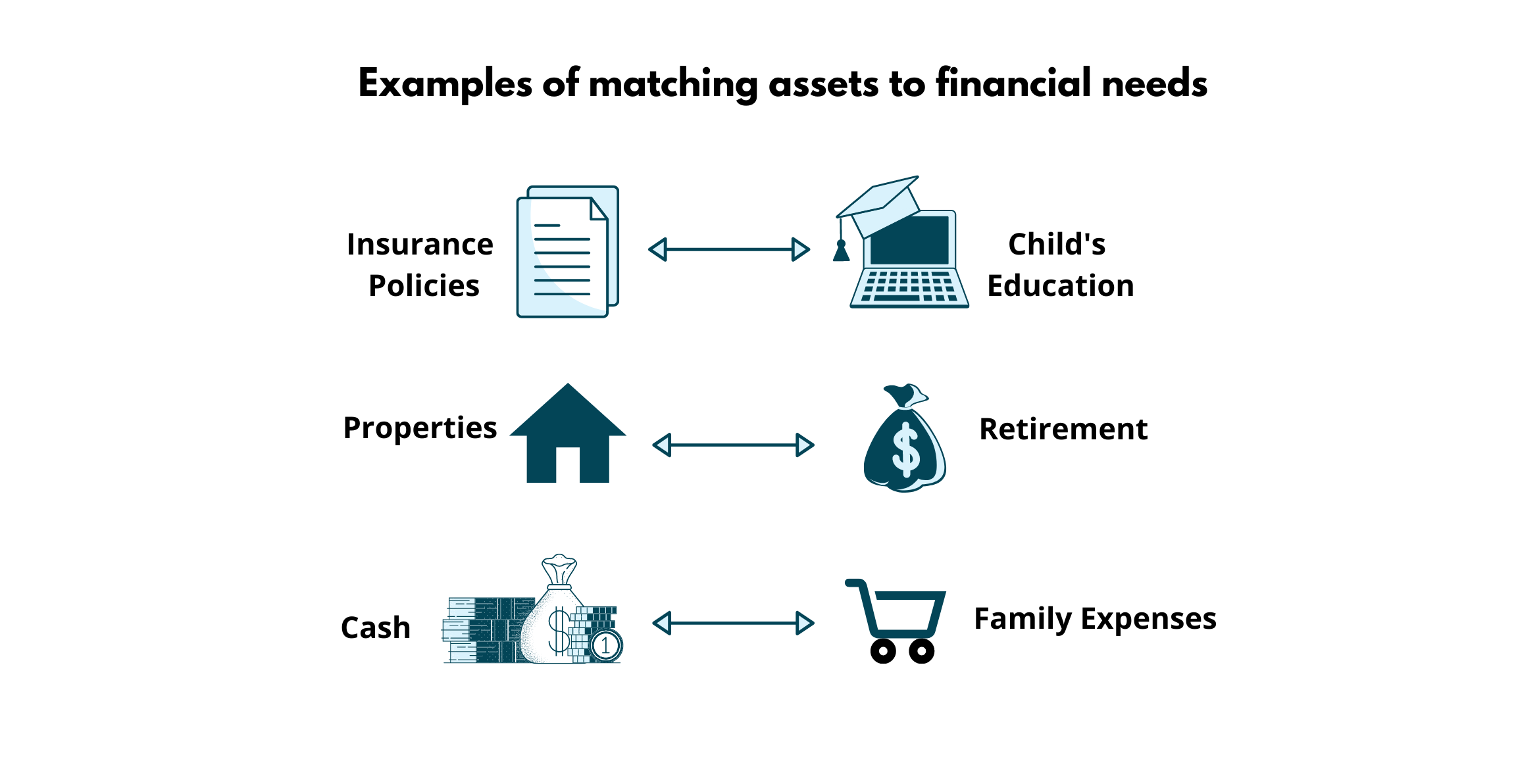

Not all assets are equal. Some assets, if sold within short notice, may result in heavy losses. Likewise, some assets may have huge potential to grow.

Based on your post-divorce financial needs, certain assets may be more useful to you and your family. Below are examples of matching a specific asset to a specific need. Once you know which asset is useful, you are in a better position to negotiate with your spouse.

3. How can you protect your financial assets for your children?

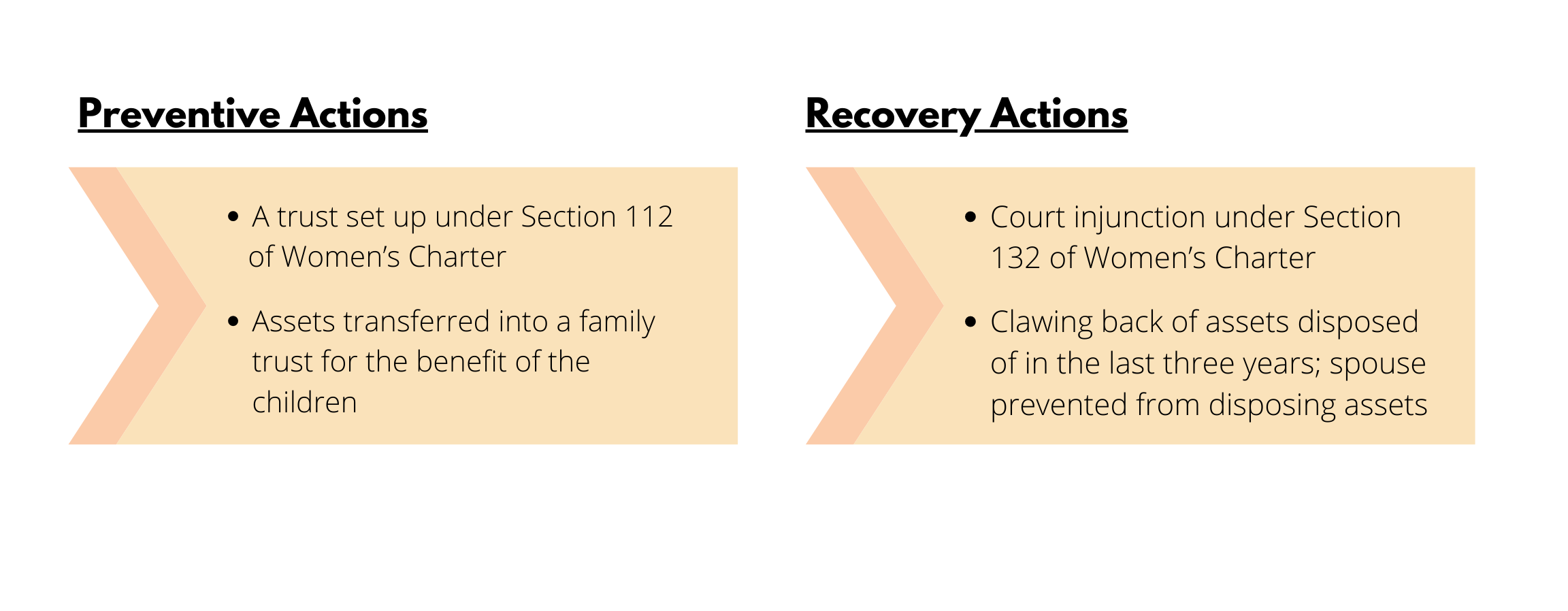

At any point of time, your spouse may dispose or transfer various assets, with the aim of reducing the division of matrimonial assets or alimony payable.

There are two possible approaches to safeguard your assets. If you are uncertain, it is advisable to speak to professionals in their specialised trade – legal and finance.

4. Should you terminate jointly owned properties?

Uncontested divorce procedures may take between three to six months, whereas a contested divorce may take up to more than six months, depending on the nature of dispute.

Should a sudden premature death happen, and the property is jointly owned, the living spouse will take sole ownership of the property. To prevent this, a conversion from a jointly owned property to a tenancy in common may be needed.

| Converting a HDB flat | Converting Private Property |

|---|---|

| Needs consent of the joint owners to convert the status of jointly owned property. Need HDB approval. | Does not need consent of the joint owners. However, a statutory declaration, stating intentions, needs to be signed and duly served by a lawyer. |

Note that if there is a charge or outstanding mortgage on the jointly owned property, the conversion may need the consent of the bank. Due to the complexities of such conversion, it is advisable to speak to a lawyer.

5. Should you update the beneficiaries of your will and insurance policies?

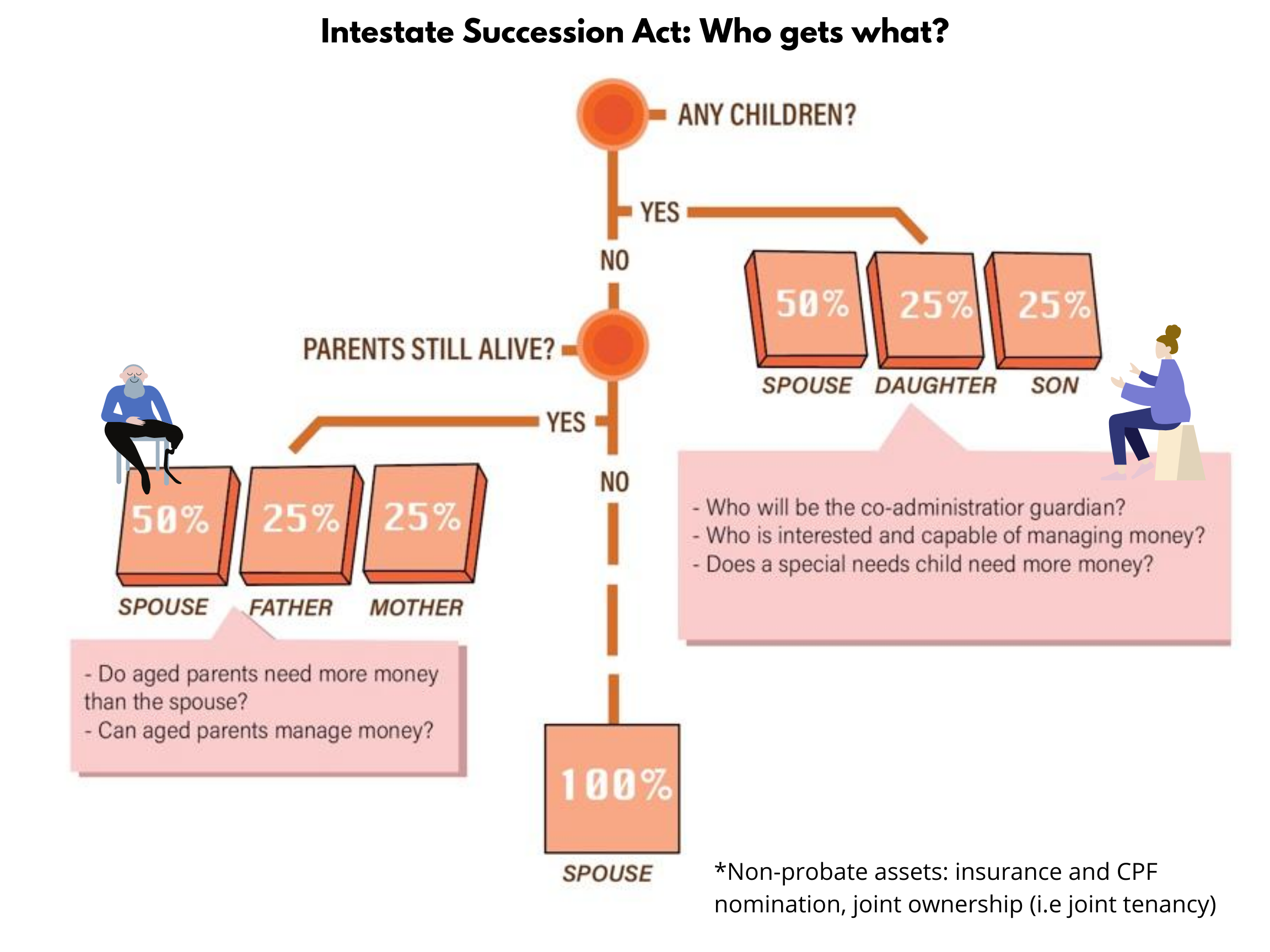

Without a will or nomination, your spouse could potentially be entitled to 50 percent of your assets under the Intestate Succession Act, as illustrated below. Having a will and nomination bypass this.

Wills and nominations are two parts of estate planning. To find out more about estate planning, you may reach out to a financial planner.

You can understand your rights and get guidance on these steps through:

- Legal clinics islandwide provide free legal advice sessions ranging from 20-40 minutes. The AWARE legal clinic provides you with a one-time, free, 20-minute legal clinic session. Call 1800-777-5555 to get a referral. Otherwise, you can check your eligibility with other Singapore legal clinics at legalclinics.sg.

- The Legal Aid Bureau provides pro bono legal aid to Singaporeans and PRs for a number of legal issues. Contact them to check your eligibility. Otherwise, foreigners can contact ACMI to check if they are able to provide legal aid.

- Some private firms offer a short free or discounted first consultation.

Counselling services are also available islandwide at various counselling centres, Family Service Centres and specialised social services, such as Divorce Specialist Support Centres. AWARE also provides individual counselling for women. To seek counselling support at AWARE, call 1800-777-5555.

By regulation, assisting in divorce financial matters is not within the scope of responsibility of a financial planner in Singapore. (This may be different in other countries.) However, you may reach out to a financial planner for general financial planning that arises out of a divorce – for example, documenting your family’s financial situation in general, making changes to your insurance plans, or selling your assets.

Future-planning for yourself and your children

In the last installment, we will be talking about financial planning for your life post-divorce. Here are some questions we’ll consider:

- How can you seek support for your changing financial needs?

- How can you balance your children’s needs with your own retirement needs?

- What can you do for your health needs as they increase with age?

Bernard is a financial educator who strongly believes in the rights of everyone to access information on financial planning. Witnessing his mother’s financial and emotional vulnerability from her marital failure, spurred him to use his financial knowledge to support women considering divorce. He currently volunteers with AWARE’s CARE services to raise awareness about the need for financial planning for women contemplating or undergoing divorce.